As part of a uni unit on public policy,1 I had to complete a 750 word policy briefing based on the report Fossil fuel subsidies in Australia 2025 by The Australia Institute. Instead of trying to be maximally efficient and doing a good job relatively quickly, I made the mistake of getting genuinely interested in the subject matter and so spent four days on the assignment, cutting an enormous amount of interesting or useful context and background information from my briefing and then getting to the point where I was rewriting parts of individual sentences in order to claw back extra word count.

I didn’t want to just permanently lose that information, so I’m dumping an edited part of my policy briefing, except with these changes:

- Selectively including more info that I couldn’t fit into my assignment’s word limit (though I wish I’d had the time to write this up earlier because I’ve honestly already forgotten some of the stuff I didn’t write about).

- Adjacent information interesting to me that would never have actually been in the real briefing, like getting sidetracked in politics or “trivia”-type errors in the report.

- Informal referencing rather than anal APA7 referencing, and a more informal tone for any of the new or edited sections where I’m not completely copy-pasting from my original briefing.

The context of the original assignment was that we were pretending to use our policy briefing to brief Jim Chalmers2 for an upcoming meeting which he had. This meant that this was an economically-focused briefing rather than, say, an environmentally-focused one.

If the subject matter interests you, I definitely recommend you check out the report itself (and other sources!) as they can go into a lot more detail than I can even in this “extended briefing”.

Firstly — and I didn’t include this in my briefing proper — wow, the report has a data error of $100,000,000 in one of its key tables. I’m pretty sure if I made that kind of mistake in a uni report then (if the assessor was paying enough attention)3 I would lose marks for that. In Table 1 of the report there’s a breakdown of total subsidies at the federal level plus a breakdown for each of the states. These expenditures are split into “spending measures” (direct spending) and tax concessions (where they count the lost revenue that would’ve otherwise been gotten from the non-concessional tax amount). But when you add up the figures for spending measures and tax concessions at the federal level, they’re $100,000,000 lower than the quoted federal assistance. By reading through the report it’s clear that this is basically just a typo (other parts of the report reference the total figure with the extra $100,000,000 absent), but still, it’s off by $100,000,000! Table 2 is also helpfully and incorrectly labelled “Table 1” (again) but with a yellow highlight on the number “1” — another “wow, really?” moment for me when reading. On this basis, I am officially docking one point from the report’s marks, and will remember this incident the next time I lose marks and receive the feedback that I could never get away with this type of error in a professional setting.

Given that karma, odds are I probably made a mistake somewhere in my own figures too. Anyway, onto the edited copy-pastes:

Summary

The report estimates that across federal and state/territory governments combined, Australia provided $14.9 billion in fossil fuel subsidies during FY2024-25. These were categorized as “wholly”, “primarily”, or “partly” dedicated to fossil fuel industries. Health and environmental effects / costs were not considered.

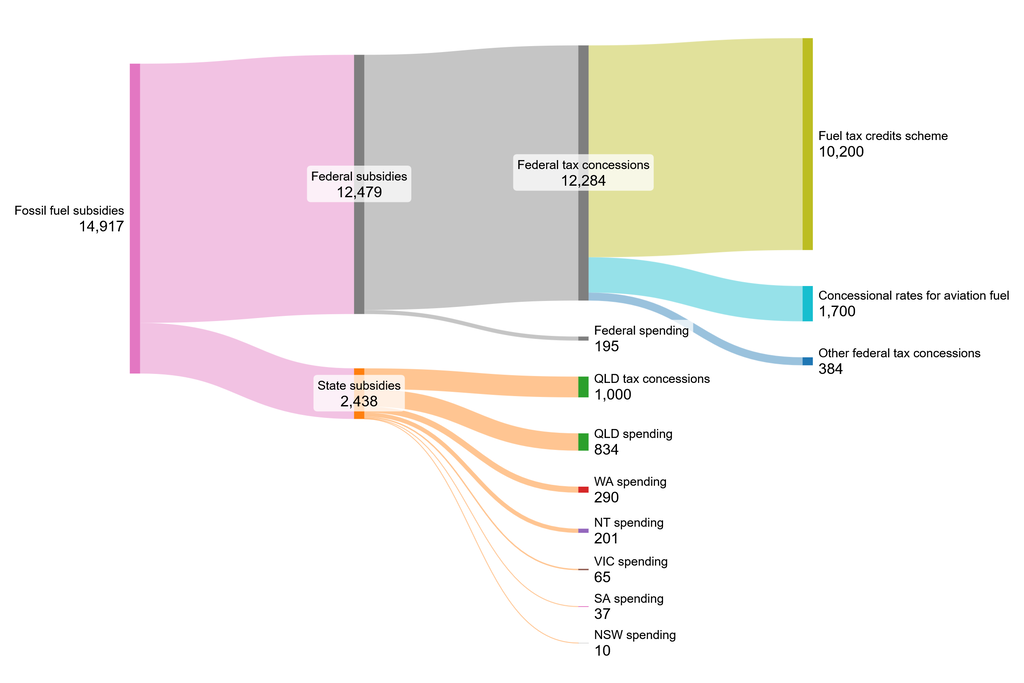

Total expenditure is dominated by federal subsidies of $12.5 billion (83.6% of all subsidies), with federal subsidies overwhelmingly comprised of tax concessions rather than direct spending. Federal concessions are in turn dominated by $10.2 billion for the Fuel Tax Credits Scheme (81.7% of federal subsidies) – the 16th most expensive item in the year’s budget – and $1.7 billion for concessional tax rates for aviation fuel usage (13.6% of federal subsidies). Essentially all (99.5%) federal subsidies are categorized as “wholly” dedicated to fossil fuel industries.

Fossil Fuel Subsidies in Australia FY2024-25 (millions of dollars)

State/territory subsidies comprise mostly of Queensland’s $1.8 billion (75.2% of state/territory subsidies), split across spending of $0.8 billion (34.2% of state/territory subsidies) and concessions of $1 billion (41% of state/territory subsidies). Contrasting federal subsidies, state/territory subsidies are a broader mix of “wholly”, “primarily”, and “partly” categorized subsidies and are less concentrated.

Total subsidies have been trending upwards and are projected to continue to rise, largely due to increasing fuel expenditure causing commensurate increases in related tax concessions. The report concludes that “Australia is not taking serious action on climate change” and suggests that “cutting fossil fuel subsidies would not only help achieve genuine reductions in emissions, but would save money that could be spent on public services”.

The report uses state/federal budget papers and annual reports from “relevant departments and agencies” from FY2024-25 when possible, using estimates based on FY2023-24 documents when necessary. The Australia Institute, though a “non-partisan” think tank, tends to be left-leaning. Both of the report’s authors have a history of publications critical of fossil fuel usage, though neither they nor The Australia Institute have known formal political or commercial ties.

Sidetracking on the summary: defining “subsidy”

This is an interesting topic of its own and something I did extra background reading on but basically had to jettison from the assignment submission in its entirety to hit the required word count.4

If you do try to incorporate costs relating to health, environment etc (externalities, to use the “proper economics term” for it), then you can attribute a much higher figure to fossil fuel subsidies. In the opposite direction, you could also choose to exclude e.g., tax concessions and only count subsidies that directly spend money. A report by the Productivity Commission actually used something closer to this in its methodology, and it consequently resulted in a much lower subsidy figure. The Australia Institute report chooses a defensible middle-ground between these two extremes, including tax concessions but not trying to factor in externalities like health/environment.

Another great source of the debate over what qualifies as a “subsidy” comes from an ABC RMIT Fact Check from 2022 (which I do refer to elsewhere in my briefing), with several experts providing a range of opinions on this question. For example:

In order to approach anything like $10 billion per year, as Mr Bandt claimed, fossil fuel subsidies would need to include fuel tax credits — but the extent to which these might be considered a “subsidy” is contested.

The argument boils down to whether credits provide a benefit or remove a penalty.

The mining industry and others5 argue the latter, on the basis that “fuel excise [tax] is an implicit road charge” that should not apply if the fuel is not being used to drive on public roads, meaning fuel tax credits simply refund businesses that should never have paid it.

It’s an interesting distinction and sounds rather convincing, but the report ends up following the recommendation of the United Nations Environment Programme (UNEP) — which broadly counts a “benefit” to count as a “subsidy” — so it’s hard to fault the report for its choice.

There’s a whole thing about whether the fuel excise is or isn’t a way to fund public roads which I won’t go into here. The Parliamentary Budget Office (PBO) has an overview of fuel taxation in Australia if you want more info about the subject in general, which includes some history about the road funding part. I collected more notes on this but honestly I just don’t think they’re that important or interesting unless your focus is on specifically the fuel excise and not just on fossil fuel subsidies more generally.

As a related aside, analysis by the European Environment Agency (EEA) shows that their fossil fuel subsidies over there seem to be at a level that isn’t compatible with meeting their existing emissions reduction targets. In the report I originally made reference to this as evidence to that data saying that winding down subsidies seems to be quite difficult if the EU has failed to make meaningful progress on the matter from the 2015-2023 period.

Sidetracking on the summary: disaster relief funding

Something included in the report’s own executive summary — and which I apparently lost marks for not including in my own summary section — is that the amount being spent on fossil fuel subsidies exceeds the amount being spent on Australia’s Disaster Ready Fund6 by a bit over 10x. This sounds good but I personally think it’s cheap politics: the amount which government spends on things is only partly based on how important they are. Generally a more important factor is how expensive the thing is. For example, the 2025 federal budget spends more money on social security and welfare than health, education, and defence combined – but that doesn’t make it more important than those, it’s just a comparatively expensive expenditure.

Whether the Disaster Ready Fund should or shouldn’t get more funding is outside of the scope of the topic of fossil fuel subsidies, and so dragooning it in like this feels like a bad comparison being made on emotional rather than practical grounds which I’m not a big fan of. Policy area #1 should get the appropriate amount of funding. Policy area #2 should also get the appropriate amount of funding. The only significant link between the two is that the same budget has to pay for both. So yes, there’s an opportunity cost, but the comparison is Policy area #1 vs everything else in the budget, not specifically Policy area #2.

I know that emotion is just a part of politics (especially in the wake of Cyclone Alfred, which is a large part of why the report itself brings this comparison up), but I can still complain about it. Had the report included more information about the funding of the Disaster Ready Fund — or if I had had the time to look into that myself — then I could include a comment about that aspect too, but alas, four days (plus a day to write up here!) already made my schedule buckle a little. On top of that I had already had to cut a couple of things in my briefing which I felt were actually pretty essential, so out this went too.

Sidetracking on the summary: what about all the other subsidies?

The report itself covers these in some detail, and from memory most of the subsidies that weren’t some kind of tax concession on fuel usage were infrastructure related, like ports and that kind of thing. Since all of these combined were a comparatively insignificant part of total subsidies at only 1/4 — and an even more insignificant part of federal subsidies at <5% of those, which are the most relevant ones to a federal minister — I didn’t look at them too hard.

This is an interesting contrast to what I would’ve expected based on public sentiment and media attention – the amount of money being spent to subsidize e.g., mining projects seems to be pretty small in the grand scheme of things. Maybe fuel tax concessions aren’t as sexy in media coverage? Or maybe I just coincidentally haven’t been exposed to much coverage about them?

Additional context

(This section, as required by the template we were told to follow, was originally called Political Context in the briefing, but there’s a lot of non-political context which I think is interesting/valuable so I’ve renamed it)

The fossil fuel industry is, naturally, a significant beneficiary of current subsidies. However, the report likely misrepresents some subsidies, with even the ABC in 2022 previously calling claims similar to those of the report “overblown”. Despite classifying fuel tax credits as “wholly” benefitting the fossil fuel industry, “the [economic benefit] is shared” between fuel users and producers. The former represents a diverse range of industries – including agriculture, forestry, tourism, and construction – who also want that subsidy maintained. The report similarly uses the “wholly” classification for aviation fuel subsidies even though the aviation sector – and its patrons – benefit as well. Basically, it seems like the report is being really weird about its definitions of terms like “wholly”, which is another thing I don’t really like about how it presents itself despite appreciating the overall message, as it makes it easy to be very critical of the report’s findings and that could be used to discredit it.

Subsidizing fossil fuels directly opposes our emissions targets, and from this perspective can be particularly inefficient due to the “offset” spending required to maintain net emissions reductions. (I didn’t have time to explore this part in more detail – being able to add some figures about how much we actually spend for the explicit purpose of emissions reductions would’ve been a helpful addition)

MPs on the crossbench are interested in reducing the subsidies (as per the report itself), which could be particularly relevant if the federal election results in a minority government.

The subsidies do periodically come up in media coverage, though the public is currently focused on “cost of living, cost of living, cost of living, and then if there’s time, more cost of living. There is simply nothing else that people are more worried about”. Subsidies somewhat tie into this via e.g., food and electricity prices (though how much is another thing I didn’t have time to explore).

I apparently lost some marks here for not being more explicit about how much the public cared. The first problem is again the ghost of word count passed, but also I don’t really know how I’m supposed to get that information without relying on media reports. I’m doubtful that “fossil fuel subsidies” are featured in many public opinion polls (though upon typing that I looked it up and there is apparently at least one relevant poll).

Sidetracking on the context: fuel excise

This is a big insight which I ended up heavily summarizing and then placing alongside my recommendations (further below) instead of in the supposed-to-be-political context section.

Even though the lost revenue from the Fuel Tax Credits Scheme is going up (due to an increasing amount of fuel usage overall), the revenue from the fuel excise itself is going down (!), which is kinda crazy. Partly this is coming from increased fuel efficiency, partly the ongoing/future electrification of most vehicles, and partly other factors. The PBO goes so far as to say that by 2050 the revenue from the excise will be “effectively zero”. This makes it seem to me a basically foregone conclusion that, sooner or later, the fuel excise is going to be either overhauled or removed (and thus the associated tax credits would be affected too).

If you keep up with policy — and especially tax policy — you’ll probably be familiar with Dr Ken Henry’s tax reform recommendations, at least in a vague sense. There’s a whole little debate going on about how the current tax system Australia has is Not Great™ for many reasons, among them that it could be reformed to be more “efficient”. In the context of tax, efficient taxes are ones that (basically) don’t interfere too much with economic output, and some taxes (even at the same revenue levels) are better or worse for this. The PBO has a whole report about Australia’s tax mix which goes into this a bit more if you’re interested. Section 3 explains the pros and cons of different tax types, and Table 3.1 at the end of that section is a nice summary. Section 3.3 goes over efficiency and also has its own little chart which I’m choosing not to reproduce in the hopes that you actually open the link and look at it directly in the report.7

Sidetracking on the context: carbon tax and other environmental policy

Inside you are two wolves. One of them says that it’s time to take another shot at a carbon tax. The other says a carbon tax is “currently politically impossible”. You are The Conversation Australia.

This is another one of those things that I cut out entirely even though I felt like a couple of lines about it were basically an essential part of the briefing. If a carbon tax were on the menu then it makes a lot of this subsidy stuff a lot less problematic-seeming, as the externality of carbon emissions could then be priced in. Even if we go with the carbon-pricing-is-impossible route, simply discussing environmental policy more generally seems, to me, really fucking important in the context of fossil fuel subsidies.

A road user charge works for replacing the fuel excise for public road users, but it doesn’t fully address those making use of the tax credits – but presumably we would want to actually incentivize those users to also reduce their fuel usage.

Word counts are an invention by BIG OIL to STIFLE DISCUSSION and HIDE THE TRUTH.

Sidetracking on the context: aviation fuel

Given that it related to the second largest subsidy, this was the other area I specifically looked at to better understand. I didn’t know much about aviation fuel before (and still don’t), nor did I know much about the related tax concessions (and still don’t). I didn’t have enough time to basically fundamentally understand why there are significant aviation fuel concessions, so that remains an open question for me without which it’s difficult to have an informed opinion about what should be done regarding aviation fuel subsidies.

The two key information sources I looked at here are the Aviation White Paper by the Department of Infrastructure, Transport, Regional Development, Communication and the Arts,8 and the.. State of Play (?) report by the.. CSIRO and Boeing (?). Sustainable Aviation Fuel (SAF) is an alternative fuel source for aircraft using renewable sources (biomass, vegetable oils, etc) and its usage/adoption is one way to reduce emissions from them, but certainly not the only way. Due to lack of time to understand this in more detail I ended up just sort of hand-waving the issue away by giving a very generic recommendation about it.

Recommendations

(These were our recommendations we were to give to Jim Chalmers to take into his hypothetical meeting – you can see the holdovers from the extra context that I had to send to the farm in pursuit of pleasing our lord and saviour Word Count)

Shorter term

- Modestly reduce expenditure on the Fuel Tax Credits Scheme (with possible exceptions for key areas such as agriculture, a carve-out which even the Greens have supported). At two thirds of all subsidies, small changes here can outweigh entire other subsidies.

Longer term

- Pursue comprehensive tax reform which includes removing the fuel excise itself, sidestepping the issue of industries reliant on the related tax credits. Changing circumstances mean that its revenue will soon be “effectively zero” despite rising revenue loss from associated credits. Replacing it with road-user charges aligns with the Productivity Commission’s recommendations and has public support.

- Continue assisting the aviation sector’s transition to alternative fuels like sustainable aviation fuel (SAF) and low carbon liquid fuel (LCLF) and the electricity sector’s transition to more renewable energy sources, reducing their respective needs for fossil fuel subsidies.

Sidetracking on recommendations: shorter term

You’ll notice that my recommendation is ultra-generic, with almost no direction about how to implement this. This isn’t because I didn’t think about it, but primarily because (again) I didn’t have much time to look into the finer details, and the little specificity I did look into and want to provide had to be cut for the sake of word count.

There is, of course, more than one way to approach implementing a reduction. The obvious one is to simply lower the subsidy, but another would be increase the conditions that you have to satisfy to be eligible for it (possibly this could be done in some kind of gradual phase-out so as to not cause a price-shock to those affected).

A supplemental policy change would be to subsidize or otherwise encourage cleaner energy sources for e.g., heavy machinery etc – though I didn’t really explore this and so don’t know how practical it is to do. I do know that there are some industries where it’s really hard (or impractical) to not use fossil fuels and still achieve similar production capabilities as today. I imagine that there are some similar cases for other fossil fuel sources but I didn’t look into it.

Sidetracking on recommendations: longer term

Firstly I have to say that I was very proud of the tax reform solution, as I’m pretty sure very few if any other students did enough background reading to discover that this was actually a great way to phase out literally the majority of Australia’s fossil fuel subsidies whilst also simultaneously fixing problems with taxation that should (in theory) boost the economy.

The recommendation is packed alongside the introduction of a road-user tax to replace the fuel excise, but a key point which I couldn’t include is that only these two actions (remove fuel excise + add road-user charges) is probably at best environmentally about net-neutral. What we really want is something that’s clearly net-positive, and this is where I wanted to at least briefly mention tying this into suggesting other policies to achieve that goal – but I couldn’t. All hail the almighty word count.

My grade

Given the disproportionate amount of time I spent on improving my brief, I was honestly gunning for 85-90.

I ended up getting 81, with all categories marked as “excellent” on the grading rubric. Kinda feels like in future I’ll need to better match my submission to the assessor’s expectations even beyond the rubric itself, which is a bit annoying but I guess that’s my fault for choosing a qualitatively assessed unit instead of just doing more CS units lol.

Update 28 April: A couple of anonymized, high-scoring briefing submissions have now been provided to students so that we had examples to learn from for our next briefing. I.. was not a big fan of the examples, primarily for the reason that they didn’t (in my opinion) adequately summarize the report — an opinion which perhaps isn’t that surprising given that I spent a large chunk of my word count doing that, whilst the examples focused most heavily on the political context. However one of the examples didn’t even provide any figures (not even the headline amount of what the total expenditure is!). This seems to come down to differing views on what the most important parts of the policy briefing were.

Whilst I maintain that not actually summarizing the report is a fundamental briefing failure (and so at least one of the two example briefing submissions was Not Great™ in that regard), at least I know that next time — at least for the sake of marks — I should try to balance better between summarizing vs providing context (especially political context, which hey fair enough that was what the section was called). I could’ve, for example, cut out perhaps half of the breakdown on where the money was going, and instead relied on the Sankey diagram to communicate some of that information for me.

It is a little shocking that we were allowed to hand-wave away so much detail in our summaries. The example briefing which did provide a more useful summary went so far as to seemingly hallucinate details of the report which I was not able to find in it. It’s possible that I just missed it after checking through it a couple of times, and it’s also possible the student writing it either got their wires crossed or intentionally smudged some extra detail into the summary in order to keep the “Political Context” section actually politically focused (I smudged some context section into my recommendations section, for example). But it’s also possible that the mistake wasn’t from the student themselves, that the assessor didn’t pick it up, and that the academic who then picked out examples to share with us also didn’t notice it. The fact that I consider it plausible fucking scares me.

- Although my course if for computer science, while at uni I’ve made some effort to get some breadth in by adding in other subjects. For the most part that meant doing extra subjects on the side, which meant sitting in on lectures / seminars, doing some of the reading, but almost exclusively skipping the assignments. However, this year I effectively gained four extra units, and I didn’t particularly like the look of any of the CS or CS-adjacent units available during the first half of the year, so I ended up taking some more of the “side” subjects “for realsies”.

- Who the parliament website suggests I should refer to as “The Hon. Dr Jim Chalmers, MP, Treasurer of Australia”, but who in the federal budget papers is actually refer to as “The Honourable Jim Chalmers MP [and then on the next line] Treasurer of the Commonwealth of Australia”. Am I not supposed to include the Dr prefix!?!? Why can’t government get their own titles correct smh.

- Which they probably wouldn’t be because they’re not paid enough to give each assessment enough time to go into too much detail 🤠

- Initially I tried to include 1-2 lines about it, but even that had to go during my later edits.

- This link is a 404, but Wayback Machine has copies if you’re curious.

- It was originally called the Disaster Relief Fund but it was renamed a couple of years ago.

- Actually reading linked sources challenge [IMPOSSIBLE]

- Arts and Transport are two very related portfolios.